These costs are regularly rolled into the loan itself and therefore compound with the principal. Common costs for the reverse home loan include: an application charge (facility cost) = between $0 and $950 stamp duty, home loan registration charges, and other federal government charges = differ with location The rate of interest on the reverse home mortgage varies.

Because the upgrade of the National Customer Credit Security Act in September 2012 new reverse mortgage are not enabled to have fixed rates. Just reverse home loan composed prior to that date can have a set interest rates In addition, there may be expenses during the life of the reverse home mortgage.

The very best items have zero regular monthly costs. When thinking about a reverse mortgage you ought to be considering a loan with no monthly charges and the most affordable rate of interest. If your bank is charging you a regular monthly charge then you ought to be considering another item. The cash from a reverse home loan can be dispersed in numerous different methods: as a swelling amount, in cash, at settlement; as a Period payment, a regular monthly money payment; as a line of credit, similar to a home equity credit line; as a combination of these.

g., re-finance a typical or "forward" mortgage that is still in place when retiring or to utilize the readily available money to pay installment or revolving debt. purchase a new vehicle; fund aged carein house or in a property aged-care center (retirement home); upgrade or repair or refurbish the house; assist the family or grandchildrenthis needs to be done carefully or Centrelink pensions may be affected under the "gifting" arrangements of Centrelink; spend for a getaway.

The Ultimate Guide To How Do Variable Apr Work In A Mortgages

This consists of physical maintenance - reverse mortgages how they work. In addition, some programs require regular reassessments of the value of the home. Earnings from a reverse home mortgage established as an annuity or as a credit line need to not affect Government Income Assistance privileges. However, earnings from a reverse home mortgage set up as a lump amount might be thought about a monetary investment and therefore considered under the Earnings Test; this classification includes all amounts over $40,000 and sums under $40,000 that are not invested within 90 days.

This includes when they offer the home or pass away. Nevertheless, most reverse home loans are owner-occupier loans just so that the customer is not permitted to lease the home to a long-lasting renter and vacate. A customer needs to inspect this if he thinks he wishes to rent his home and move somewhere else.

g., goes to an aged-care center or relocations someplace else) your home must be offered. This is not the case; the loan needs to be repaid. Therefore, the recipients of the estate might decide to pay back the reverse mortgage from other sources, sale of other properties, or perhaps re-financing to a normal mortgage or, if they certify, another reverse home mortgage.

An extra charge might likewise be imposed in case of a redraw. Under the National Credit Code, charges for early repayment are prohibited on new loans since September 2012; however, a bank might charge a sensible administration fee for preparation of the discharge of home loan. All reverse home loans written since September 2012 should have a "No Negative Equity Warranty".

How How Do Arm Mortgages Work can Save You Time, Stress, and Money.

This implies you can not end up owing the lending institution more than your house is worth (the market worth or equity). If you participated in a reverse mortgage before 18 September 2012, examine your contract to see if you are safeguarded in situations under which your loan balance ends up being more than the value of your home.

Where the home sells for more than the quantity owed to the lending institution, the customer or his estate will get the additional funds. According to the October 2018 filings of the Workplace of the Superintendent of Financial Institutions (OSFI), an independent federal company reporting to the Minister of Finance because month, the impressive reverse home mortgage financial obligation for Canadians soared to $CDN3.

Daniel Wong at Better Dwelling composed that, the jump represented a 11. 57% boost from September, which is the 2nd biggest increase because 2010, 844% more than the mean monthly rate of growth. The annual boost of 57. 46% is 274% larger than the typical annualized speed of growth. Reverse home mortgages in Canada are readily available through 2 financial institutions, HomEquity Bank and Equitable Bank, although neither of the programs are insured by the government.

To qualify for a reverse mortgage in Canada, the customer (or both customers if married) should be over a specific age, at morgan and morgan intake specialist least 55 years of age the customer must own the property "entirely or nearly"; in addition, any impressive loans secured by your home must be retired with the profits of the reverse home loan there is no credentials requirement for minimum earnings level.

Unknown Facts About How Do Buy To Rent Mortgages Work

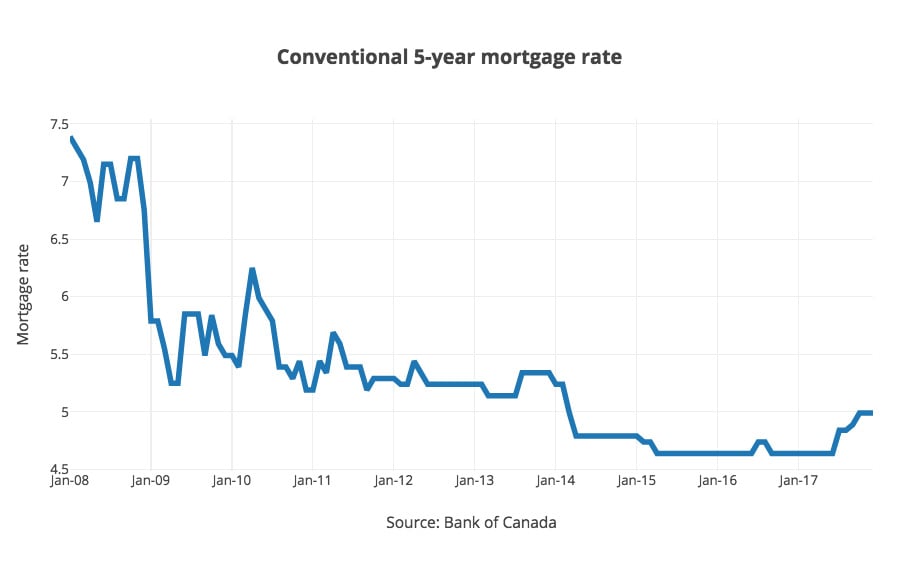

The precise quantity of money available (loan size) is figured out by a number of elements: the borrower's age, with greater quantity readily available for higher age current interest rates home worth, including area and an element for future gratitude program minimum and maximum; for instance, the loan might be constrained to a minimum $20,000 and a maximum of $750,000 The interest rate on the reverse home mortgage varies by program.

Specific costs depend upon the particular reverse home loan program the customer gets. Depending upon the program, there may be the list below types of expenses: Realty appraisal = $150$ 400 Legal suggestions = $450$ 700 Other legal, closing, and administrative costs = $1,750 Of these expenses, just the property appraisal is paid in advance (out of pocket); the remaining expenses are rather deducted from the reverse home mortgage proceeds.

" The cash from the reverse home mortgage can be used for any purpose: to fix a home, to pay for in-home care, to deal with an emergency situation, or simply to cover day-to-day costs." The borrower retains title to the home, consisting of unused equity, and will never ever be forced to abandon your house.

This includes physical maintenance and payment of all taxes, fire insurance and condominium or upkeep costs. Money got in a reverse home loan is an advance and is not gross income. It for that reason does not affect federal government advantages from Old Age Security (OAS) or Ensured Earnings Supplement (GIS). In addition, if reverse home mortgage advances are utilized to purchase nonregistered investmentssuch as Look at this website Surefire Financial Investment Certificates (GICs) and mutual fundsthen interest charges for the reverse home mortgage may be deductible from financial investment earnings earned. [] The reverse home loan comes duethe loan plus interest should be repaidwhen the debtor passes away, offers the property, or moves out of your home.

The Best Guide To How Do Second Mortgages Work

Prepayment of the loanwhen the debtor pays the loan back prior to it reaches termmay sustain wesley remote charges, depending upon the program. In addition, if interest rates have actually dropped because the reverse home mortgage was signed, the home loan terms might consist of an "' interest-rate differential' charge." In Canada a reverse mortgage can not accumulate debt beyond the reasonable market price of the residential or commercial property, nor can the lender recuperate losses from the homeowner's other properties.